Special Needs Trusts

Content

Disabilities to Qualify for a Special Needs Trust

Trusts and Social Security

Special Need Trusts and the Omnibus Budget Reconciliation Act of 1993

Similarities of All Special Need Trust

The difference between Third Party Special Needs Trust and First Party Special Needs Trust

Third Party Special Needs Trust

First Party Special Needs Trust/ Supplemental Trusts/ Family-Type Special Need Trusts

Pooled Trust

Court-Ordered Special Needs Trust

Other First Party Trust Considerations

Employee Identification Number (EIN) IRS

EIN Number Online Step by Step

State Trust Registration

Choosing a Bank or Financial Institution

Setting up a special needs trust is not that hard if it is a Third Party Special Needs Trust. There are many possible trusts which will be explained below. This webpage’s main focus is about Third Party Special Needs Trusts which fits the best for using with a disabled child/adult in most situations.The hardest part of a special needs trust is understanding how it can be used for a disabled child/ adult who is getting some benefits from Social Security and Medicaid or will in the future. This will be the case for any child/adult that will require an assisted living situation. SSI payments are used to partially pay for a group home residency.

Throughout this webpage the use of beneficiary is used as the term for a special needs child/ adult in relationship to a trust.

Top

Disabilities to Qualify for a Special Needs Trust

Anyone can set up a trust for themselves or other people. They do not have to be disabled.You can set up a trust for any disabled person even if they are not receiving any government benefits.

A Special Needs Trust exempts all or some assets from a means test for Social Security, Medicaid, court fees and other services. There are tests to qualify for Social Security as a disabled person. The ability to qualify for SSI, whether you receive SSI or not, would be the qualifications needed to have a Special Needs Trust or else the “Special Needs” part of the trust is essentially meaningless.

See Definition of Disability and Disability in Children on the Social Security webpage for more information on what qualifies as disabled by Social Security: http://raisingautism.net/socialsecurity.html#definition

Top

Trusts and Social Security

Trusts are legal arrangements regulated by state law but the state laws are written to comply with social security and the IRS. The following Social Security regulations should be kept in mind for all trusts.With a revocable trust all assets in the trust are considered to be the property of the beneficiary. In most cases, there is really no use in having a revocable trust for a special needs individual.

With an irrevocable trust, unchangeable, all assets may or may not be considered assets of the beneficiary. It depends on how a first party special needs trust is set up and where the assets come from or how the money is paid out. With a Third Party Special Needs Trust this is not a problem.

A beneficiary of SSI can have no more than $2,000.00 in assets to receive full benefits. Benefits may be reduced or stopped until the assets of the beneficiary are below $2,000. The house a beneficiary lives in or their car (up to a certain value $4,500 (2016)) are not assets that are counted against receiving SSI.

If assets of the beneficiary are greater than the eligibility asset requirement of Social Security ($2,000.00 SSI though there is now ABLE), Medicaid (uses the same $2,000.00 SSI threshold though there are 209(b) Medicaid states that may have more restrictive requirements), and court fee waiver (will vary by state but generally if the beneficiary qualifies for SSI court fees will be waived and trusts will not be counted in the means test), the beneficiary will have to spend down the assets below the asset requirement before those services kick in again.

Suspension of SSI payments may affect the receiving of other social services based on SSI eligibility and payments including caregiver, day programs, and group home. This will depend on state laws and rules.

You will be required to keep all receipts during the spend down. Spending must be reasonable for the benefit of the beneficiary. You cannot have a big party and blow off the money.

Payments directly to a beneficiary will reduce their SSI benefit.

Any money used to pay for food or shelter will reduce SSI benefit to the beneficiary by no more than $264.33 (in 2016), even if the beneficiary does not touch the money.

Money can be paid to another party to provide the beneficiary with items other than food and shelter. This does not reduce their SSI benefits or endanger them. Items that are not "food or shelter" include medical care, telephone bills, education, entertainment, etc.

Social Security regulations exclude temporary, nonrecurring or sporadic income, from the definition of income. Recurring payments like paying the monthly cable or electrical and gas bills may qualify as income especially if it is monthly. A way around this is to pay such bills sporadically by paying forward a few months. If the disabled person is in a group home these bills will not be a problem. Interestingly, anything educational like lessons or speech & language are not considered income even with monthly payments. To see the full list of what Social Security defines as income and non-income see: https://www.ssa.gov/ssi/text-income-ussi.htm

Social Security will also not count the trust if counting it causes you hardship, and you meet the undue hardship criteria. https://secure.ssa.gov/poms.nsf/lnx/0501150126

Top

Special Need Trusts and the Omnibus Budget Reconciliation Act of 1993

The Omnibus Budget Reconciliation Act of 1993 officially recognized First Party Special Need Trusts /Supplemental Trusts and set the parameters for how they should work. While Third Party Special Need Trusts are different, they must still adhere to the spending restrictions set up by The Omnibus Budget Reconciliation Act for Social Security, Medicaid, Medicare, and other government programs.First-Party Special Need Trusts can also be referred to as an OBRA, or (d)(4)(A). The trust full statutory cite is 42 U.S.C. section 1396p(d)(4)(A).

The text of the Omnibus Budget Reconciliation Act of 1993 that deals with Special Need Trusts: http://raisingautism.net/laws/omnibusbudgetact1993.html

The Omnibus Budget Reconciliation Act of 1993 full text: https://www.congress.gov/bill/103rd-congress/house-bill/2264/text

Top

Similarities of All Special Need Trust

All special needs trusts are designed to supplement but not supplant the entitlement programs like Social Security and Medicaid.All trusts are legal entities that require a tax number – EIN (explained further below).

All trusts can be established and funded by parents and family members. After the parents die, they can also create a Special Needs Trust by directing its creation in their will.

If a party other than the beneficiary puts assets into a first party special needs trust, those assets become assets of the trust and maybe of the beneficiary (depending on how the trust is set up). It can be like giving money directly to an individual and subject to IRS gift rules or inheritance rules. People can leave money to the trust in their wills.

Parents can purchase a life insurance policy payable to the trust.

There is no monetary amount minimum to set up a Special Needs Trust. You can set up a checking account to hold all the funds.

Use of any Special Need Trust template documents it best to not change any of the legal language in the document. You are mainly designating the beneficiary, trustees, successor trustees, and designating what should happen to any remaining assets of the trust once the beneficiary has died.

Top

The difference between Third Party Special Needs Trust and First Party Special Needs Trust

Third Party Special Needs Trust

A Third Party Special Needs Trust is a legal entity set up for the benefit of a person with disabilities with assets from a third party (parents, grandparents, etc). A Third Party Special Needs Trust can receive property from a will, living trust, life insurance policy, or other assets. Grandparents can designate in their will that assets go to the trust instead of the disabled grandchild. The assets cannot come from the beneficiary of the trust nor will the assets of the trust be the beneficiaries in the future. The beneficiary can have no control or say in a Third Party Special Needs Trust.Payments made from a Third Party Special Needs Trust should be made directly to a person or company providing services or goods to the beneficiary. The service and goods cannot be food or shelter. The beneficiary should not receive any money from the trust and then pay it to a third party because it is then considered an asset of the beneficiary.

Third Party Special Needs Trusts are not subject to any government payback provision like Medicaid, Medicare or court fees.

After the death of a beneficiary of a Third Party Trust, the remaining assets can be disbursed by the trustee(s) in accordance with the rules when the trust was set up.

Top

Setting Up a Third Party Special Needs Trust

Lawyer

Using a lawyer would be recommended if your finances are complicated or you are also doing a will and other legal documents. A special needs trust can be a part of the package.Do It Yourself

The easiest way I know is to buy or check your library for the book by NOLO press Special Needs Trusts by Attorneys Stephen Elias & Kevin Urbatsch list price at $34.99 but I think you can get it for between $20-25 dollars. The book goes through everything about special needs trusts and even when you may need a lawyer instead of the book. The book allows you access to a download Third Party Special Needs Trust template that you can fill out to suit your needs. It goes step by step through the process. While the book goes into all special needs trust, it is specially designed to address a Third Party Special Needs Trust. The process is easy but takes time.Your state may offer Special Need Trust examples, forms, or information.

This pdf has an example of a Third Party Special Need Trust within the document:

http://static.store.tax.thomsonreuters.com/static/samplePages/Sample_Checkpoint_WAEDF.pdf

Link to the same document on this website if the above does not work:

http://raisingautism.net/pdf/thomsonreuterssamplethirdpartysnt.pdf

Top

First Party Special Needs Trust/ Supplemental Trusts/ Family-Type Special Need Trusts

The trust must be established by a parent, grandparent, guardian or the court.The trust must be "irrevocable," that is, unchangeable.

The beneficiary must be under age 65 at the time the trust is established.

First Party Special Needs Trust can be tricky and can require knowledge of not only federal regulations but state laws.

First party special needs trust can be partially or fully funded or not at all by assets from the beneficiary (in this case a person born with disabilities). The trust can be funded by income, inheritance, court settlements, or lottery winnings by the beneficiary. The trust can be funded solely by parents and other family members.

Depending on how the trust is set up, some or all of the money in a first party special needs trust could possibly be taken into consideration as an asset of the beneficiary for services and support from Social Security, Medicaid, and court fee waiver.

If a First Party Special Needs Trust is to be funded by a personal injury claim by the beneficiary, Medicaid, if used by the beneficiary for the injury, must first be reimbursed for the medical care given by the wrongful acts that generated the recovery. This payment comes only from that portion of the recovery that is specifically allocable to past medical expenses and costs of the settlement. Other parts of a settlement cannot go to Medicaid at this time but can be recovered at the death of the beneficiary. After the reimbursement of Medicaid has been fulfilled, the remaining amount of the settlement can be used to fund a First Party Special Needs Trust.

At the beneficiary's death, the state Medicaid and Medicare agency must be reimbursed for all medical assistance given the beneficiary before the remaining amount can be inherited by someone else.

Some first party special need trusts are more flexible in how money can be used including basic items like housing, food or clothing. The best-written trusts are usually careful to stick to broad but accepted wording and follow the language of the both federal and state statutes and do not deviate from them.

***If you have a will already written you will need to amend it so that the inheritances for a special needs child go to the trust you have set up and not in the child’s name. Any future rewrite of a will should also do the same.***

Top

Pooled Trust

Pooled Trusts are formed by non-profit associations that pool money together so that they are of an amount to access “sophisticated” trust services. Pooled trusts pool the funds of many beneficiaries, then manages and invests them. Each beneficiary has his or her own account. Pooled trusts can handle much smaller accounts.The disadvantages of a pooled trust are that the non-profit has control of the disbursements. Any money left in the trust after the beneficiary dies stays in the trust to help others with disabilities.

Court-Ordered Special Needs Trust

A court-ordered trust or Type A special needs trust is used when a disabled person is under court supervision where the disabled person has inherited money or received a court settlement and that money would otherwise disqualify them from receiving government benefits. The court determines that it would be best for the money to be used for the disabled person throughout their life instead of having it be spent down to requalify for government benefits. A court-ordered trust can be set up by the parents, grandparents, legal guardian, or the court itself. The disabled person has to be under 65 years old and meet the medical standards of Social Security, in terms of the disability. The trust has to specify that after the disabled person has died, any funds remaining will be used to pay back the state of residence for whatever medical assistance the government provided to the individual after the trust was set up.Top

Other First Party Trust Considerations

Medicaid

- States can have different rules as to what assets are included or excluded from consideration for eligibility. The beneficiary may still be eligible for Medicaid but have to pay a premium until assets are below the requirement. If Medicaid has paid out in the past, the beneficiary will probably have to pay back for service until the assets are spent down. This is not the case with a Third Party Special Needs Trust.The big problem is if the beneficiary is determined to not be currently eligible for Medicaid because of asset means test, they will have to be enrolled in another health insurance plans until their assets are spent down and then re-enroll in Medicaid, a lot of work, headache, and potential disruption in health insurance.

Besides winning a court settlement, inheritance in the beneficiary’s name, winning the lottery, a beneficiary can suddenly go above an asset requirement if a family member has set up an educational fund in their name, like 529 College Saving Plan or Coverdell Education Savings Account. Grandparents can cause headaches even though they are well intended. Instead they can give money to set up a third party trust that will be used to help a person with disabilities throughout their life including education.

Court Fee Waiver

- If prior court fees have been waived in the past (Conservatorship), you will have to pay back the waived fees and pay all future court fees until you go below the court fee waiver asset requirement. You will have to reapply for court fee waiver once the assets have been spent down.Top

Employee Identification Number (EIN) IRS

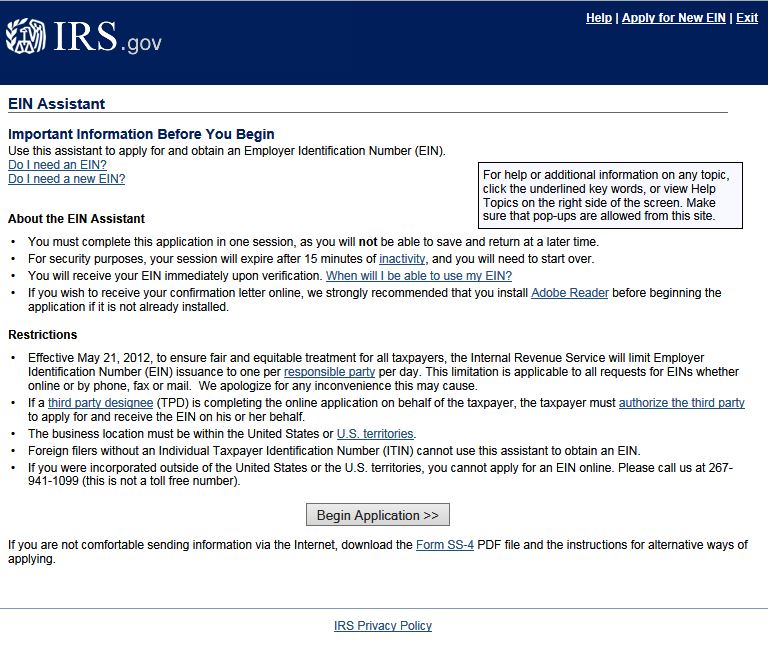

All trusts, except certain grantor-owned revocable trusts*, need an EIN number from the IRS.*Grantor-owned revocable trusts where people place all their property and assets into so that their assets can go to their beneficiaries at their death according to their will without going through probate court. It is not a trust that is considered a special needs trust.

Only get your EIN number directly from the IRS. It is free. You can do it online and after you finish giving the IRS the information required you will automatically get your EIN for the trust. This link will take you to the IRS webpage start:

https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

Beware there are “business” that will happily file for you for a fee for an EIN number. They can even have webpages that sort of look like the IRS webpage. So check the URL for www.irs.gov because you will be inputting the trustee(s) social security number.

The online EIN application must be done in one session.

Alternatively, you can download and mail in Form SS-4 pdf: https://sa.www4.irs.gov/modiein/individual/help/keyword.jsp?keyword=Form SS-4

Top

EIN Number Online Step by Step

Getting an EIN number for the first time can be intimidating because the IRS’s beginning page does not tell you what you need on hand to complete the application. There is also a tricky part during the process in selecting what trust type for a Special Needs Trust as it is not listed.Things you need to know before you get started:

Name and Social Security number of the responsible party- Most likely you the parent if you are setting up the trust. Use the Social Security number and the name of the parent that is normally used as the primary Social Security number when you file your taxes.

Name of the trustee - If two parents are trustees, use the name of the parent whose Social Security number you previously entered. Trust mailing address and telephone number- Most likely your home address.

Exact name of the trust, county and state where the trust is located, and the date the trust was funded Number of employees the trust will have over the next 12 months- Usually zero.

It is easier to apply for an account and fund the account once you get an EIN number. It is best to apply for an EIN number in the month you will be funding the Special Needs Trust. See the last IRS EIN Assistant screen shot below.

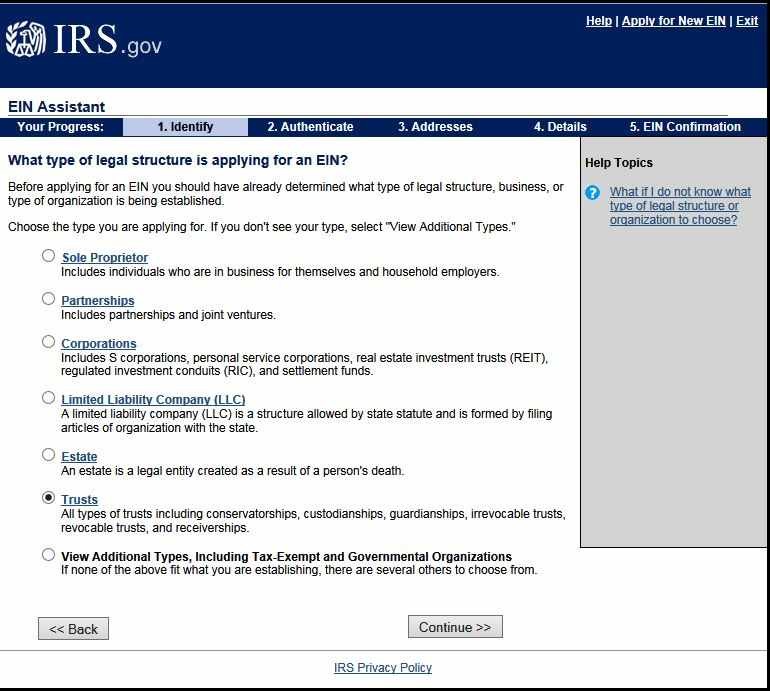

Read popup. Click OK.

Read

Select Trusts

This is the tricky part. You can see on this page Irrevocable Trust, Revocable Trust, and Trust (All Others). If you click on the names to get more information, you will not see Special Needs Trust listed.

This is a screen shot of the information pop up for Trust (All Others):

By now you have read a lot about trusts and without Special Needs Trust listed you may think Irrevocable Trust should be selected, but select Trust (All Others).

Select Individual

Input information about you.

Select Individual

Input name of one of the trustee(s).

Select I am the grantor, trustee, or a beneficiary having a material interest for the trust.

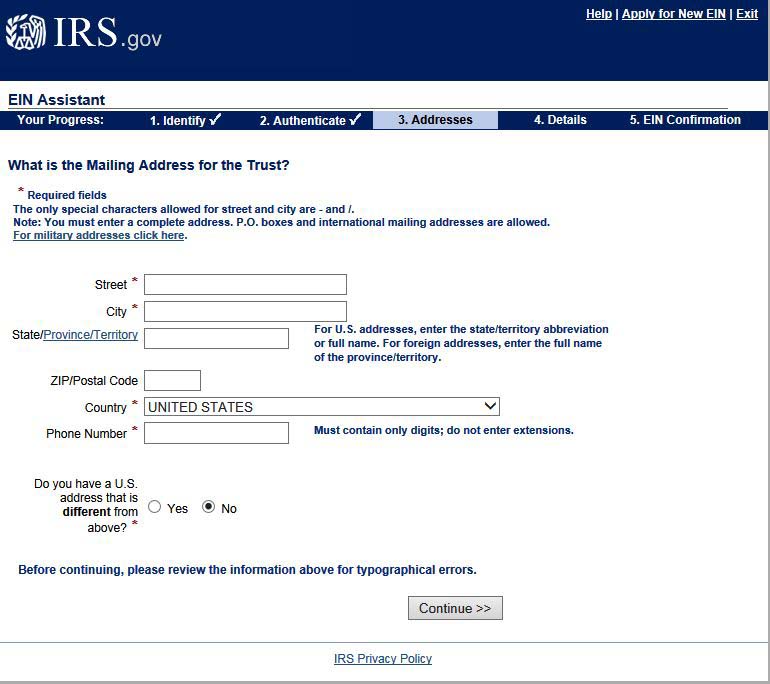

Input the address and phone number of the trust.

The IRS will compare the address you gave them with their database address. There may be slight differences like you spelled out Street and they have the abbreviation St. If the IRS data base address is correct, click on Accept Database Version.

Enter the Legal name of Trust and other * entries. The “Date Trust funded” should be the month and year you are apply to get an EIN number. It is harder to set up a trust at a bank or financial institution before you get an EIN number. Once you have an EIN number for the trust it is easy to set up an account at a bank or financial institution.

**At this point I stopped taking images because I did not want to input a bogus trust name and trigger an EIN and the next pages are easy.

Select whether the trust currently has or intends to have any employees within the next twelve months or not on the “Tell Us More About the Trust” page, then continue.

You will probably input zero employees.

Choose whether you want to receive the EIN confirmation letter online or have it mailed to you. Be aware that it can take up to four weeks to receive the letter by mail. Continue to the last page.

Print at least two copies of the EIN confirmation letter and keep them in a safe place.

I print the page to pdf and then I can print or fax the EIN confirmation letter as many times as I need.

Sending an EIN confirmation letter via attachment to an e-mail is unsafe. The EIN number is like the Social Security number for the trust.

Top

State Trust Registration

Depending on the state you may have to register the trust with the state.Top

Choosing a Bank or Financial Institution

Things to consider when choosing a bank or financial institution for a Special Needs Trust:You want to have access to the trust funds to pay for services and goods for the beneficiary. Checks, debit cards, and credit card are the easiest. The trust can be in a simple checking account. If the trust has a lot of money, you will want a brokerage account with a checking account tied to it.

Parents do not often outlive their children, so you will want to consider your named successors access to the trust if they live away from you or the beneficiary.

To open an account at a bank or a financial institution you will need all the information that was required to get an EIN number plus the EIN number. The bank or financial institution will probably ask for a copy of the first page of the trust.

The bank or financial institution will report to the IRS any interest or realized gains or losses of the trust each year just as they do for an individual. The IRS filing rules for trusts are the same as for individuals. State filing rules will vary.

Top